Abstract: This essay examines the relationship between national tax policy and inequality. Tax policy changed dramatically in the last two decades of the 20th century with the rise of neoliberal economic policy insisting on a dramatic reduction of maximum marginal rates of income tax and a lowering of corporate tax rates. The essay deconstructs the justification for these policies, and argues that they have helped to increase levels of inequality.It also addresses the tax problems that have arisen by virtue of the globalization of economic activity and proposes measures to bolster the ability of the nation state to protect and indeed promote its tax base.

This content is restricted to site members. If you are an existing user, please login. New users may click here to subscribe.

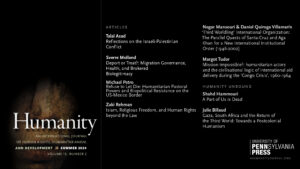

Current Issue

📘'Choose Your Bearing: Édouard Glissant, Human Rights and Decolonial Ethics' is now available for pre-order!

❕Grab your copy and save 30% OFF using the code NEW30 at checkout : https://edin.ac/3JIcRne

@HumanityJ

Login Status

If you are not a subscriber, you can sign up now.